Discretion Grants

The grants are targeted to address national priorities

Stakeholder Portal

Please Register or Sign-in to access the system

Global Skills

Microsoft Global Skills Initiative

Batho Pele Digital Skills

Microsoft and the PSETA Partnership

Unemployed Youth

Facilitate the development of learning programmes

PSETA Accreditation

Certification is usually for a certain period

Assessors & Moderators

Assessor Moderator application form

OUR NEWS UPDATE

OUR NEWS UPDATE

Read our Latest

Articles Post

PSETA as a public entity within the ambit of the Department of Higher Education and Training (DHET) derives its Constitutional mandate from Section 2 read with Schedule 4 of the Constitution which lists education at all levels, excluding tertiary education as a functional area of concurrent national and provincial legislative competence.

News

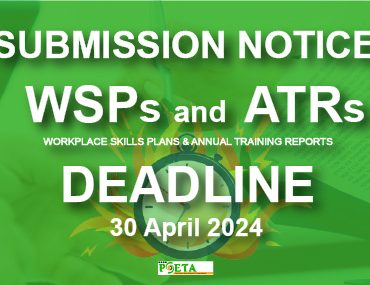

16 Apr

Tender

02 Apr

Uncategorized

27 Feb